what does a stock being oversold mean

Aug 31 2015 446 PM EDT. As per my reading on this topic it seems like Oversold is when a stock is trading below its expected value and Overbought is when it is trading about the expected value.

Oversold Stocks Screener Marketvolume Com

While the sell-off has caused its share price to decrease dramatically the new lower price does not reflect the assets true value so its likely a price rally will follow.

. This is different from the market price being incorrect. STOCK REPORTS BY THOMSON REUTERS. Real-time last sale data for US.

NEW YORK TheStreet -- Oversold and overbought are two. Technical and Commodity Calls. An asset is considered to be oversold when it is trading at a price that is lower than its perceived intrinsic value.

When your portfolio is unbalanced it may mean that you are too heavily invested in one thing. That is simply impossible. Being able to determine when the market is being overbought or oversold can significantly improve your trading performance.

It happens during a long downtrend. The market price always reflects the real value of a stock. You can consider a stock is over-sold as long as it is trading at prices below its intrinsic value or actual value.

Its a technical term an oversold stock means the stock has been sold way too much and its considered a good time to buy usually for swing traders for short term gains. Overbought vs Oversold talking points. Overbought means an extended price move to the upside.

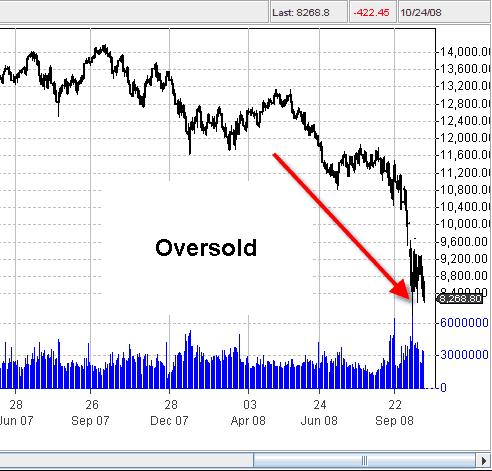

The oversold market shows that the asset is trading below its fair value. New 52-week lows have crushed new 52-week highs as one might expect. One of the common ways to notice trends for stocks that are.

The price reaches extremely low levels and then it reverses. An overbought stock is a stock that is trading at a premium to its. The opposite of a stock being oversold is a stock that is overbought.

Oversold is an overused term that investors should scrutinize before using as an infallible indicator. Some technical indicators and fundamental ratios also. This is also known as being overweight And if you dont have enough of a certain investment in your portfolio you are considered underweight.

When price reaches these extreme levels a reversal is possible. That means the breadth difference with a measure using all optionable stocks is far worse than the measure using only NYSE stocks. An oversold stock is a stock that is trading at a discount to its intrinsic value.

Stock quotes reflect trades reported through Nasdaq only. The opposite of a stock being overbought is a stock that is oversold. Just because a stock is oversold doesnt mean its cheap a stock can continue to collapse for years if the company is under performing.

Oversold stock meaning An oversold stock means that a companys shares are currently under heavy selling pressure but have the potential to bounce back. However the determination of accurate expected value of a stock is the where all the research comes in. After all an oversold condition implies that investors think the market is down further than it should be.

Details stock report and investment recommendation. Set price volume and. An oversold stock has a current price the viewer thinks is lower than the inherent value of the stock.

You may hear investing analysts on financial shows say the market is oversold and get the idea that its time to buy stocks. This means buyers should snap up shares before the market rebounds. Also the term oversold and overbought gets associated when there is a sudden drop or spike in price.

Oversold to the downside. While no doubt investors would like the choices that make up their portfolio to always go up the reality is more complicated. Oversold to the downside.

Using the same logic of an overbought stock the fact that a stock is oversold does not mean it is an underperforming stock. This could happen for various reasons including bad news about the company or its industry. The price is changing direction all the time.

The investing game is rarely plain sailing. Overbought means an extended price move to the upside. This means that in the eyes of analysts the asset has the potential to rise in price.

That means they expect the price of the stock to go up at some point in the future. All quotes are in local exchange time. Typically oversold stock means that the supply of shares outweighs demand.

Intraday data delayed at. When price reaches these extreme levels a. Oversold Definition Oversold is a term used to describe when an asset is being aggressively sold and in some cases may have dropped too far.

Oversold Meaning Indicators Examples Vs Oversold

Determining Overbought And Oversold Conditions Using Indicators

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

Oversold Markets 4 Things To Consider

Oversold Meaning Indicators Examples Vs Oversold

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

Trading Overbought And Oversold

Oversold Stocks Short Term Marketvolume Com

Overbought Vs Oversold And What This Means For Traders

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

Overbought Vs Oversold And What This Means For Traders

Overbought Vs Oversold And What This Means For Traders

Overbought And Oversold Meaning And Example Stockmaniacs

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)